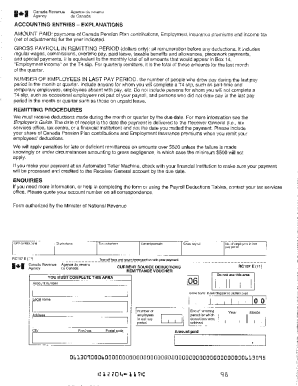

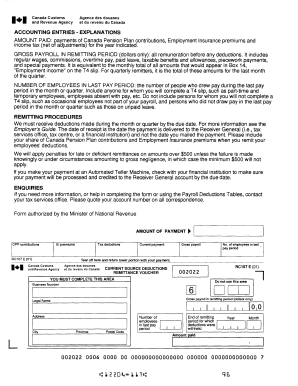

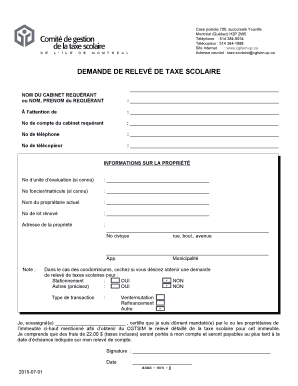

Who needs a T7DR(A) Form?

This Form is necessary for every taxpayer who is paying taxes in traditional (non-electronic) way.

What is a T7DR(A) Form Used for?

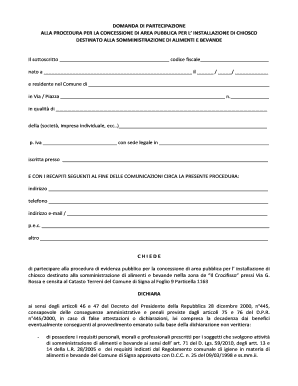

As far as Canada Revenue Agency accepts non-electronic methods of payment (money orders and checks) government requires some kind of personalization while receiving them. On this purpose T7DR(A) Form exists. T7DR(A) Form is a remittance voucher that has to accompany check or money order while filing to the Canada Revenue Agency.

Is a T7DR(A) Form Accompanied by Other Forms?

While being accompanying Form, it has to be filed with check or money order that proves the payment of taxes.

However T7DR(A) should not be joined to the payment proof with staples, paper clips etc.

Taxpayer should pay attention to the fact that T7DR(A) DOES NOT accompany cash. It is only used with the forms of payment listed above.

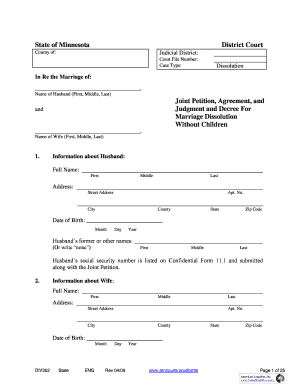

What Information Should be Provided in a T7DR(A) Form?

The following information has to be mentioned while filling a T7DR(A) Form:

- First name and initial

- Last name

- Mailing address

- Social insurance number

- Amount paid

When is T7DR(A) Form due?

As T7DR(A) is an accompanying Form it doesn’t habit's own due date. However, every time taxpayers are using non-electronic type of tax payment they have to include a remittance voucher T7DR(A) into a letter with check or money order.

What should I do with a T7DR(A) Form after its completion?

After filling a T7DR(A) Form correctly it should be filed to the Canada Revenue Agency which is 875 Heron RD, Ottawa ON K1A 1B1.